End of Service Benefits (ESB) in Saudi Arabia

End of Service Benefits (ESB) are the awards that an expatriate is entitled to once he works in the Kingdom of Saudi Arabia. There are certain cases and factors that let the employer decide on which basis the cash benefits are awarded to the employee at the end of the working service. We’ve summed up the categories that the employees belong to and explained a detailed procedure of how this will work.

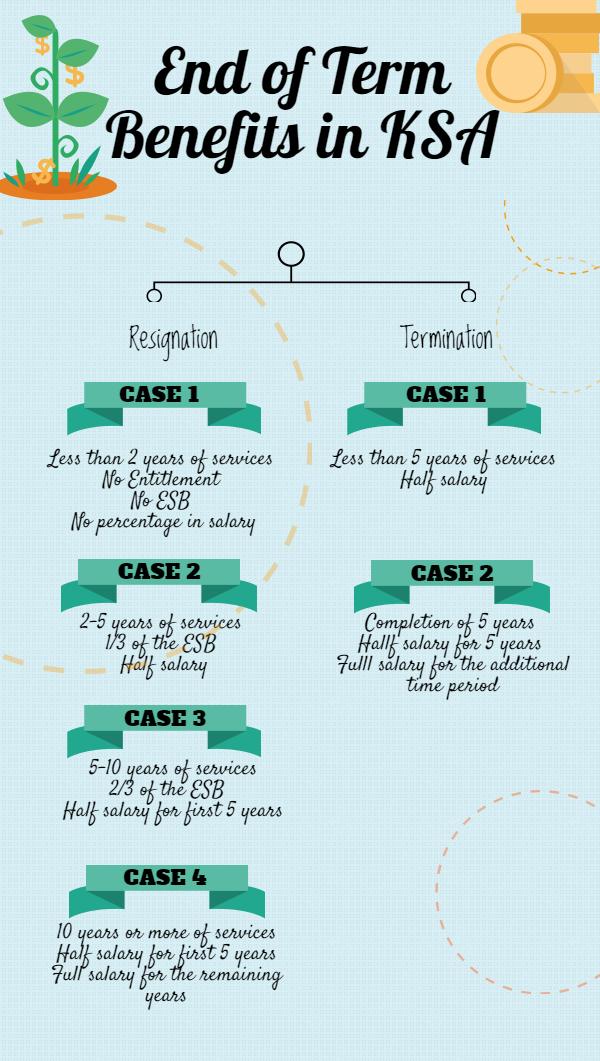

Keep in mind that there are two situations in awarding of the End of Service Benefits. The first situation is where the employee resigns and the other situation is where the employee is terminated by the employer.

An infographic on ESB awards and cases

ESB for employees who have resigned from the company

Category 1

The summary of this category if the employee has worked in a firm for less than two years then he will not be entitled to any End of Service Benefits that include no percentage of Salary will be rewarded and he will be subjected no entitlements.

Category 2

The second case lists those employees that have worked between 2-5 years in the Kingdom are entitled to 1/3 of the End of Service Benefits. The percentage of salary in this case will be half of the employee’s salary.

Category 3

If the employee has worked in the firm between 5-10 years, he is subjected to 2/3rd of the End of Service Benefits and will receive full salary for the next 5 years.

Category 4

This final category lists the employees that have worked more than 10 years in the firm. These employees will be rewarded with full End of Service benefits. In this category the employee receives half salary for the first 5 years and full salary is provided to him for the rest of the years completed.

Now let us consider the other situation.

ESB for the employees who have been terminated by their employer

Category 1

If an employer has terminated its employee before completing 5 years of service to the company then the employee will be rewarded with half salary.

Category 2

If an employee has completed 5 years in the company and then has been terminated then he will be accounted with half salary for the first 5 years and full salary for the additional time period he has worked for.

The End of Service Benefit can be claimed easily from the companies. The employers pay it to the expatriates ho have finished their services by resignation or termination. As for the women employees if they resign within 6 months of the date of their marriage or three months of the date of giving birth then they will be getting the full rewards of ESB.

You may also fill in the details in the End of Service Benefits calculator by filling all the eligible conditions here https://www.laboreducation.gov.sa/en/Contracts/End-of-Service-Award-Cal-5823

Subscribe To Our Newsletter

Join our mailing list to receive the latest news and updates from our team.

You have Successfully Subscribed!