People Exempted From Dependent Fees

Expatriates Exempted From Dependent Fees

As it is well known, starting from 1st July, 2017 government as implemented Dependent Fees of SR 100 per month per dependent and this fees will increase to SR 200 on 1st July, 2018. To know complete details about Dependent Fees – Payment, procedures, conditions for dependent fees see our article FAQ – Dependent Fees – All you want ask about dependent fees

Though dependent fees is applicable for all expatriates irrespective of nationality or position, there is one category of employees to whom the Dependent fees is not applicable – Expatriates working in government organizations. Amazing but true – there is no dependent fees for the expatriates or their dependents if the expatriate head of the household is working directly in government sector.

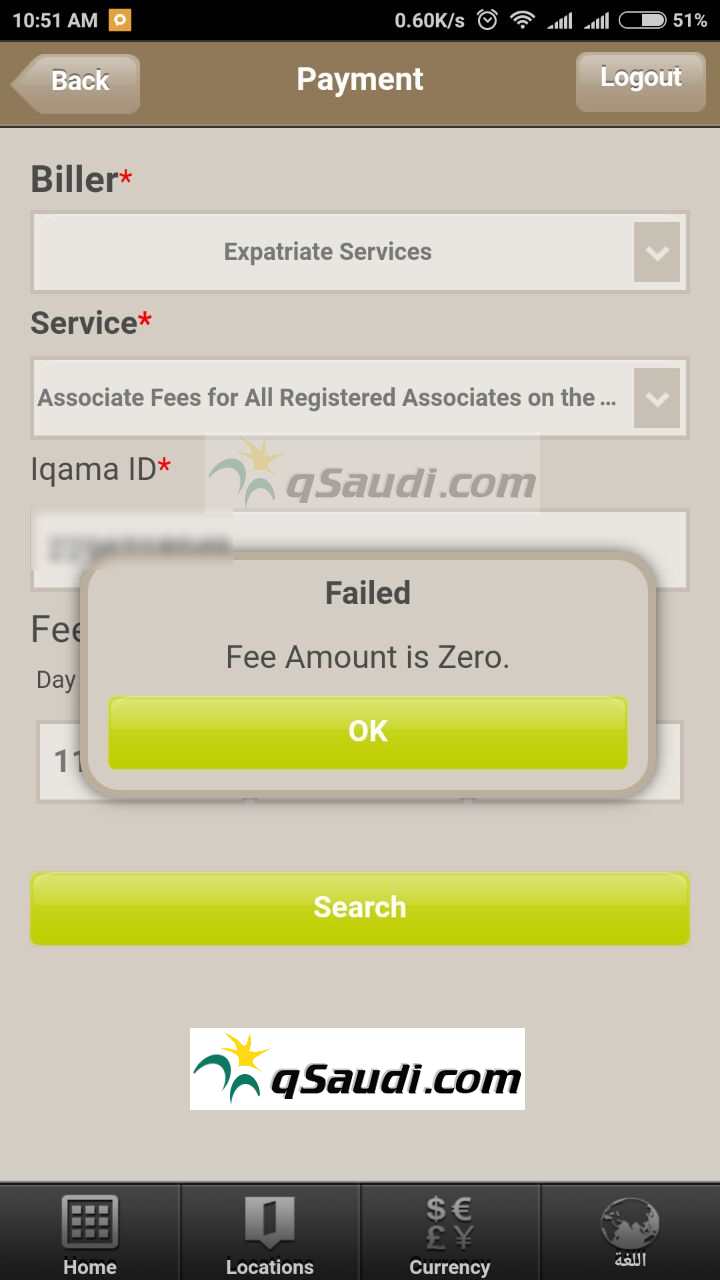

If such a person tries to make payment through the back, they will get a message

“Fee amount is zero. Ref. L76”.

Error message photos

From SABB bank

Zero Dependent Fees

From Alinma bank account (mobile app view)

This rules is applicable to all direct government employees who are expatriates but this is not applicable to expatriates working in government sector through contractor.

To know all about Dependent fees – Payment, procedures, conditions & rumors see FAQ – Dependent Fees

The procedure to pay dependent fee online can known in this article – https://qsaudi.com/pay-dependent-fees-online-bank-sadad/ – The procedure does not apply to government employees.

Subscribe To Our Newsletter

Join our mailing list to receive the latest news and updates from our team.

You have Successfully Subscribed!